Our generation can make a difference

Sustainable investing involves thinking about both the financial returns AND the social and environmental impact of investment decisions.

While there are subtle differences between each provider, the overall aim of sustainable investment funds is to deliver competitive returns, better value for money and contribute positively to important issues such as climate change.

Sign up to receive more information on sustainable investing.

Sign up for more information on sustainable investing

How does sustainable investing work?

Managers of sustainable investment funds carefully consider the Environmental, Social and Governance (ESG) factors of a company, alongside other financial outcomes and business factors, before investing in it.

This means fund managers:

- Avoid the bad by excluding companies involved in controversial activities. Industries to be avoided include tobacco, armaments, nuclear power, pornography, and fossil fuels such as coal.

- Support the good by investing in companies that do a better job of managing environmental, social and governance (ESG) issues. such as human rights, animal welfare, treatment of workforce, gender diversity, environment, climate change, governance, pollution and renewable energy.

- Support change by looking for funds that use their voting rights as shareholders to hold companies accountable and to represent the views of the clients.

Environmental, Social and Governance factors

Here’s a quick overview of what each of these factors include:

Environmental

Environmental factors cover themes such as climate change, greenhouse gas emissions, water usage, carbon footprint, recycling, renewable energy, and a company’s relationship with environmental agencies.

Social

This consists of people-related elements like issues that impact employees, customers, consumers, local community and society. Examples include workplace health and safety, product safety, employee diversity, animal welfare and donations to the local community. Social factors also considers the types of businesses a company is associated with, and if they have similar values.

Governance

This relates to the strength of the board of directors, company oversight, relationships with shareholders, executive compensation, transparency of communications with stakeholders, and whether they use any political contributions to gain favourable treatment.

Does sustainable investing deliver higher returns?

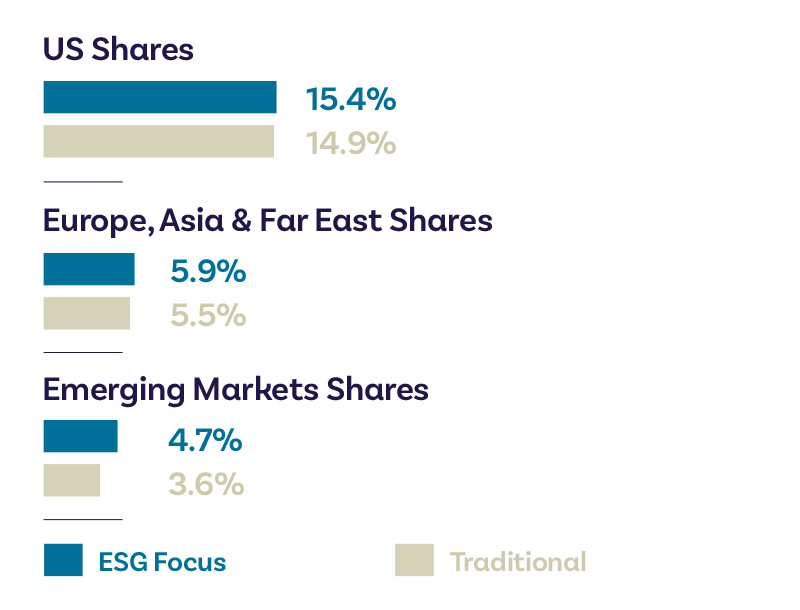

A common investing myth is that sustainable investment funds do not perform as well as traditional funds. However, data from BlackRock, the largest index investment manager in the world, shows otherwise.

Sources: BlackRock Sustainable Investing, August 2020 with data from MSCI

This graph covers from 3 December 2012 to 31 August 2020. The figures shown relate to past performance – the graph does not display previous or expected returns of a particular fund. Instead it displays the annualized returns of market fund indices. Remember that you do not invest in market indices – you invest in a fund which tracks market indices. The past performance of a market index is not indicative of any future returns, and returns over different periods may differ. Index performance returns do not reflect any management fees, transaction costs or expenses.

We want to make a difference

At AdviceFirst we’re committed to providing a range of funds and investment strategies to you. We’re members of the Responsible Investment Association of Australasia (RIAA), supporting the growth of responsible investing in New Zealand and Australia. We work with our providers to bring you a range of Sustainable Investment funds that have been thoroughly researched by expert third parties including BlackRock, the largest index investment manager in the world and Morningstar.

Let’s talk

When you are ready to discuss investing in sustainable funds, reach out to an AdviceFirst adviser on 0800 438 238 or email letstalk@advicefirst.co.nz.

Or find our more about sustainable investing with our email series.