Keep up to date

Stay informed and inspired with insights from our experts. Explore our collection of articles covering essential finance updates, thought leadership from our financial advisers, and the latest industry trends to help you make smarter financial decisions.

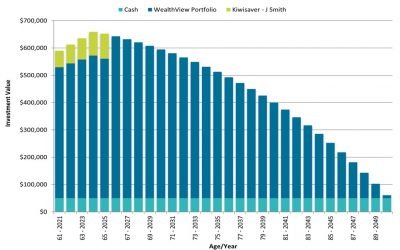

Understanding your retirement investment projection

You have just received an investment projection from your financial adviser. On first glance it looks as though you’ll be running out of money in retirement. It’s been a long day and suddenly you feel an unwanted sense of panic. Stuffing the report into the folder marked “retirement”, you head to...

Trauma insurance – help when you need it most

Nobody likes to think about serious illness or injury, but putting the right insurance policies in place will help protect your finances should you find yourself in these situations. One of our clients, James*, 61, was diagnosed with prostate cancer over a year ago. As you can imagine this was a...

New housing policy: a boon for diversified investors?

The Government has announced significant changes to taxation that will affect residential property investors. Designed to slow runaway house prices, the phased removal of mortgage interest deductibility from rental income was unexpected and received a mixed response. For those looking to buy a...

Sustainable Investing or greenwashing?

Sustainable investing is becoming increasingly popular with more and more Kiwi’s showing their interest in the environmental, social and human capital impacts of the funds they are investing in. Due to this demand several funds have sprung up that are labelled “responsible”, “ethical” or...

How we are helping Kiwis with their future

Recently we helped Helen*, aged 61, review her current insurance policies. Helen has had Trauma cover since 2002 and as part of our standard process we explained her policy back to her so she could more easily understand what she was covered for. During this conversation, Helen mentioned she was...

Transitional Financial Advice Provider Licence

In November we were granted our Transitional Financial Advice Provider Licence. This licence is an important milestone and is required as part of new legislation that is coming in to practice from March 2021. This legislation aims to improve access to high quality financial advice for all New...