You have just received an investment projection from your financial adviser. On first glance it looks as though you’ll be running out of money in retirement. It’s been a long day and suddenly you feel an unwanted sense of panic. Stuffing the report into the folder marked “retirement”, you head to the couch and pick up the TV remote……………

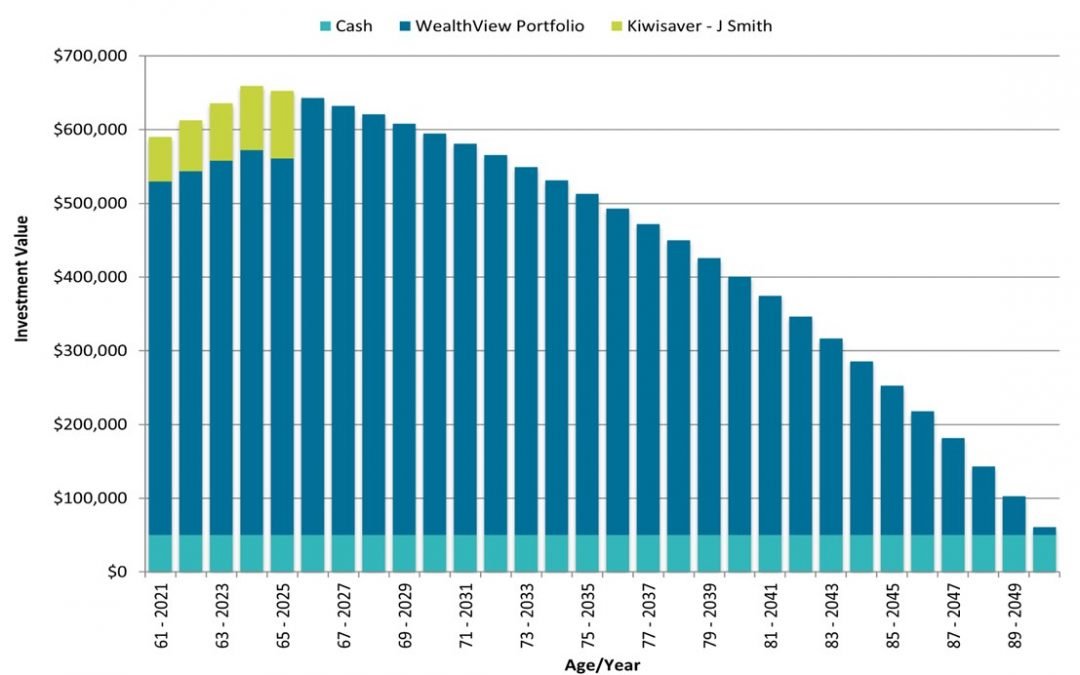

For many of us, wondering how much we will need to save for retirement and what sort of lifestyle we will afford remains a niggling concern. Talking to an AdviceFirst adviser and developing a financial plan can be the first step in taking control of how you will fare financially come retirement. After an initial assessment, your adviser will send you an investment projection like the one above.

Your first reaction is to feel concerned – your money looks like it might run out by age 90. Or, you might be relieved that it will last that long, depending on your expectations. However, it’s important to read a bit deeper and see what’s behind that projection:

1. Check the Assumptions

Before you file that report, check to make sure you understand the assumptions. How much has your adviser projected you saving and is this realistic? Will you really keep working until 65? Has your adviser adjusted the drawings for inflation or will your purchasing power decline over time?

2. How much Income will you have (and can you live off it)?

Unless you have a clear idea of your budgeted expenditure in retirement, your adviser may well have come up with an annual drawing figure from your investments that is the maximum you could draw on a regular basis. You should add this amount to your expected pensions or NZ Superannuation and check it against your budget.

3. What might change?

Often you have in mind things that may change in the future – perhaps you expect an inheritance, or you plan to downsize – or to renovate. If you expect big changes in your finances that you haven’t discussed with your adviser, then the projection may not be as helpful as it could be.

So when you receive an investment projection from your adviser, don’t be put off – read through the detail, make sure you’re clear on the assumptions and give some thought to your income needs. An Investment Projection is a living document that will evolve with your plans, so make sure you keep reviewing it each year with your adviser. If it’s been awhile or you’ve had a change in lifestyle, call your AdviceFirst adviser on 0800 438 238.