The New Zealand Institute of Economic Research (NZIER) recently looked at key drivers behind the 20% gap in retirement savings balances between men and women. They found that labour force participation, career gaps, the pay equity gap, changes due to motherhood, and low confidence and knowledge of KiwiSaver were all factors.

The biggest contributor to the gap is caused by women taking time away from the workforce and not continuing their KiwiSaver contributions.

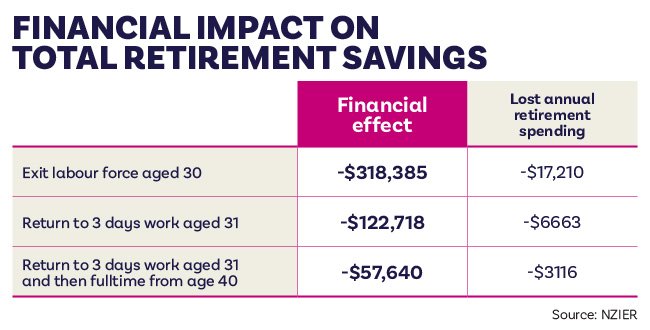

It was found that a woman on the median wage continuing to work full time through her working life could end up with a balance of around $513,000 by age 65. In comparison, a woman taking a year off, then working three days a week after that would lose $122,000 of that potential balance. If she returned to full-time work by the age of 40 that reduces the hit to $58,000. A single year out of the workforce resulted in a $15,000 reduction.

Any break in contributions to your retirement savings can have compounding effects later in your life.

The study also examined the fact that women tend to be more risk-averse and less confident regarding investing and were more likely to sit in a conservative investment fund. If you consider an average annual return of 2.5% for a conservative fund compared with 4.5% for a growth fund, sticking with a conservative fund for your working life could mean around $298,000 less to spend in retirement.

So, what can you do to improve your KiwiSaver retirement balance?

- Check your KiwiSaver investment fund

It’s important that any money you have invested in KiwiSaver is maximised and your choice of investment fund can make a big difference to your balance come retirement. The best investment fund for you is based on your personal circumstances; age, when you want to withdraw your money, your attitude to risk and the type of lifestyle you want to enjoy come retirement. If you need help choosing an investment fund our team can help.

- Keep contributing when you’re not working

While you’re taking a career break to care for children or older family members try to make regular voluntary payments to your KiwiSaver account through your provider or the IRD website. In addition to growing your balance, if you are eligible, you can continue to receive as much of the $521 government contribution as possible. Contribute $1042 throughout the KiwiSaver year to receive the full amount.

- Don’t miss out on your employers’ contributions

When you return to work, try and contribute the minimum 3% of your earnings to receive your employer’s contribution. Your employer only has to contribute if you do so try not to miss out on this great benefit. You can contribute 3%, 4%, 6%, 8% or 10% of your gross (before tax) wage or salary – if you can contribute more than the minimum 3%, do it!

- Get help from our advice experts

You don’t have to figure out your KiwiSaver strategy on your own. If you need help choosing an investment fund or developing a financial strategy our team is here to support you. Our advisers don’t receive commissions so you can be sure they are working with your goals and best interest in mind. To get in touch just call 0800 438 238 or email letstalk@advicefirst.co.nz.