If you’re following the news around the US Tariffs, it’s likely you may have questions about what this means for you and your financial plan.

To recap what’s been happening, the US has imposed tariffs on China, Canada and Mexico. In response, retaliatory tariffs have been promised by these countries, causing further concern for consumers and investors. Since the US tariffs have come into effect, the S&P 500 (the index for the US’s top 500 companies) has seen a lot of volatility – which is usually how markets react to uncertainty.

Before we delve into the nitty gritty of what this could mean for your investment portfolio or KiwiSaver balance, let’s explain what a tariff actually is:

A tariff is a type of tax that gets imposed by a country on imported goods. They are often a tool used to help protect a local economy by encouraging spending and production of local goods, and deter purchasing of goods that come from outside of the home country, since the cost of the tariff is most often past onto the consumer, making said product more expensive than the locally produced one. On paper, this might sound like a nice thing, particularly in the midst of the ‘support local’ era. However, we are a society that relies heavily on global trade. So, as it stands there is lots of speculation on the ripple effects the US imposed tariffs might have on the global economy.

The impact of these tariffs in the short-term

We mentioned earlier that the S&P 500 has experienced volatility since the tariffs have taken effect. As the news unfolds, this might continue. However, those who are only invested in US equities will likely feel the impact of this at present.

For us in New Zealand, economist Brad Olsen explains that day-to-day Kiwis would be hard pressed to notice the impact of the latest tariffs except through exposure to the US market.

Many managed funds and KiwiSaver funds will likely be diversified across a number of industries, countries and asset types. This diversification enables your investment to weather the unpredictability of the markets. If you want clarification on where your money is currently invested, your wealth adviser will be happy to answer any questions.

For consumers, the main concern for many is how these tariffs will impact inflation both globally and locally in New Zealand, and what this might mean for the next round of interest rate cuts. However, there is not enough information to fully grasp the impact of this, so the message again is to continue with your current plan as per usual but keep this in mind for future cash flow planning.

Diversification and long-term planning remain king

Uncertainty in the financial markets is ever present. While we know things may feel particularly uncertain and scary at this time, the important thing is to remember the vision of your long-term plan. Market fluctuations happen, and this is where diversification helps us. We know that investments can drop in value from time to time, and we do our best to minimise this risk through a well-diversified portfolio so that the drops aren’t felt so heavily.

A reminder to stay the course

It’s easy to feel overwhelmed when uncertainty abounds, especially when it’s reflected in your investments. However, these reactions are often short-term, and history has shown us time and time again that hard times come and go and, even when crises cause market volatility, they adapt and recover.

If you’re a long-term investor, we recommend you remain committed to your wealth plan and stay the course if your needs haven’t changed. Making sudden changes in response to short-term noise often causes more harm than good.

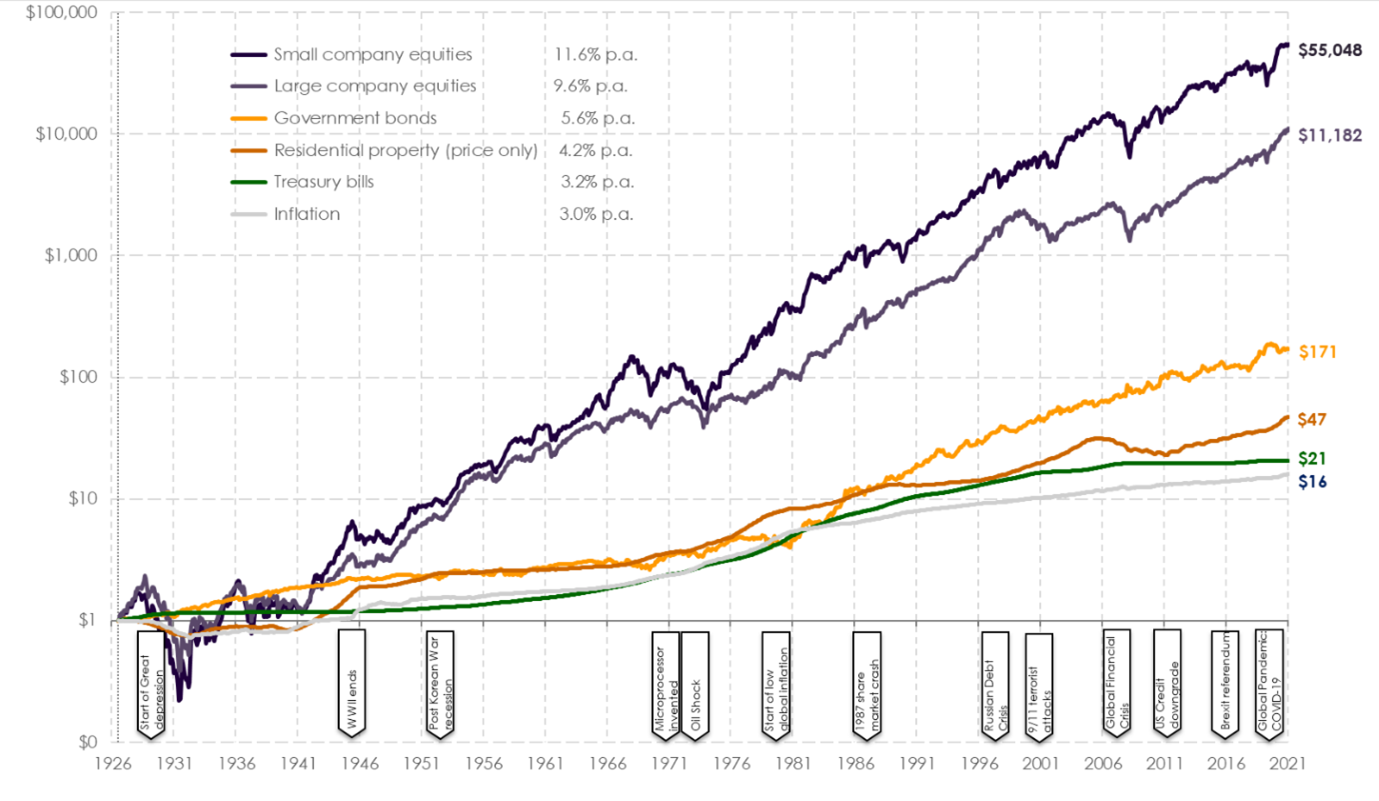

To illustrate how markets recover from significant events, consider the graph below. It shows the different investment classes back to the 1920s, and how they responded to all the major financial crises that have cropped up along the way. It clearly shows that short-term volatility is eventually replaced by the long-term trend: up.

Beware of media bias

Our modern world has constant and immediate access to news and financial opinion, and there is nothing more newsworthy than a crisis. It is easy to get drawn in by the media talking about trade wars, recessions, inflation, crises, and crashes. Nothing sells like bad news, but it’s not helpful to make decisions based on headlines, and certainly not without all the information relevant to your situation and circumstances.

Much of the current anxiety stems from the uncertainty around what might happen next. You may be seeing headlines speculating trade wars or further imposed tariffs, and all of this can be hard to predict. This brings us back to why we focus on sound financial planning. We plan so we can make progress, but we also plan for when things don’t go to plan. The future will always be uncertain, but the best way to navigate this is by strengthening our financial foundations, committing to our long-term goals, and working to control our controllables.

Focus on the long-term wins, not the short-term losses

The nature of investing means there will always be losses and wins. Human nature tends to give more weight to the losses and not enough recognition of the growth that happens in the good times. This is your reminder to look at your fund performance over time, not just at one moment in time.

When is it appropriate to make changes to your portfolio?

One of our core beliefs is to stick to your goals and your plan to achieve them, rather than chopping and changing when the market is volatile. However, things do evolve, your needs and circumstances may differ, and with all things considered you may still feel that it is time to make a change if:

- Your investment timeframe has shortened

- Your personal circumstances have changed

- Your investment values have changed.

If so, we are always here to help. The benefit of working with the team of Wealth Advisers at AdviceFirst is that we can properly assess your situation and help you determine the best options for your circumstances.

Disclaimer: This blog is for informational purposes only and does not constitute individual financial advice.